Understanding the Relative Strength Index (RSI) Indicator

In the world of technical analysis, the Relative Strength Index (RSI) is a powerful momentum oscillator used to measure the speed and change of price movements. Developed by J. Welles Wilder Jr., the RSI has become a staple for traders and investors looking to identify potential buying and selling opportunities in the market.

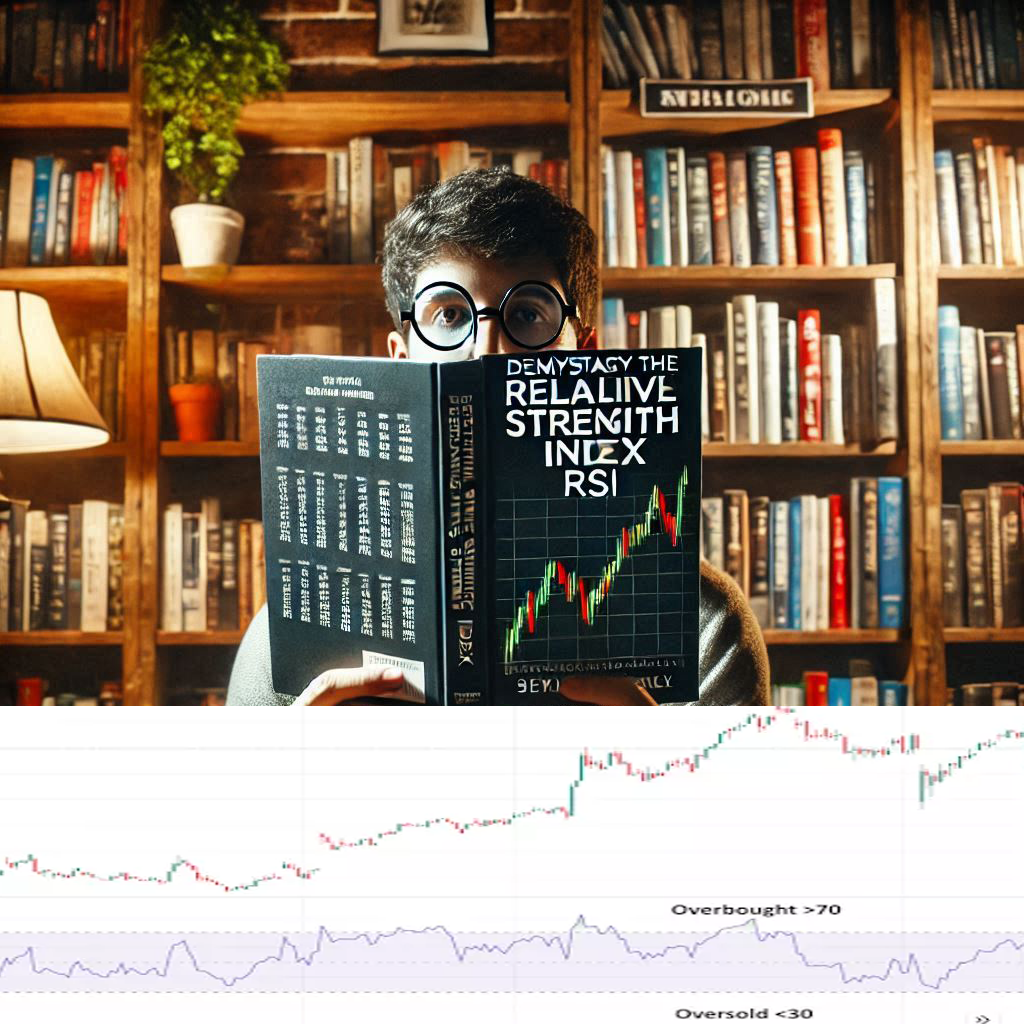

What is the RSI?

The RSI is a momentum oscillator that ranges from 0 to 100. It is typically used to identify overbought or oversold conditions in a market. The RSI is calculated based on the average gains and losses over a specified period, usually 14 days. The formula for calculating the RSI is as follows:

Where RS (Relative Strength) is the average of n days’ up closes divided by the average of n days’ down closes.

How to Interpret the RSI

The RSI can be interpreted in several ways:

- Overbought and Oversold Conditions:

- An RSI above 70 is generally considered overbought, suggesting that the asset may be due for a price correction or pullback.

- An RSI below 30 is considered oversold, indicating that the asset may be undervalued and could experience a price increase.

- Divergences:

- Bullish divergence occurs when the RSI forms higher lows while the price forms lower lows. This suggests a potential upward reversal.

- Bearish divergence happens when the RSI forms lower highs while the price forms higher highs, indicating a potential downward reversal.

- Centerline Crossover:

- When the RSI crosses above the centerline (50), it is considered a bullish signal.

- When the RSI crosses below the centerline, it is seen as a bearish signal.

Using the RSI in Trading

The RSI can be a valuable tool for traders when used in conjunction with other technical analysis indicators. Here are a few strategies:

- RSI and Moving Averages:

- Combining the RSI with moving averages can help confirm signals. For instance, if the RSI indicates an overbought condition and the price is also above its moving average, it might strengthen the case for a potential sell signal.

- RSI and Support/Resistance Levels:

- Observing RSI levels around significant support or resistance levels can provide insights. An oversold RSI near a strong support level could signal a buying opportunity, while an overbought RSI near resistance might indicate a selling opportunity.

- RSI and Trendlines:

- Drawing trendlines on the RSI chart itself can help identify potential breakouts or breakdowns. A trendline break on the RSI could precede a similar move in the price chart.

Limitations of the RSI

While the RSI is a versatile and widely used indicator, it does have its limitations:

- False Signals:

- The RSI can sometimes generate false signals, particularly in a strongly trending market where the price can remain overbought or oversold for extended periods.

- Lagging Indicator:

- As with most technical indicators, the RSI is lagging and relies on historical price data. This means it may not always predict future price movements accurately.

Conclusion

The Relative Strength Index (RSI) is a valuable tool for traders and investors, providing insights into market momentum and potential reversal points. By understanding how to interpret and apply the RSI, one can enhance their trading strategy and make more informed decisions. However, it is essential to use the RSI in conjunction with other technical indicators and analysis techniques to improve accuracy and reduce the likelihood of false signals.

![]()