Navigating the Current Stock Market Scenario

The stock market is a dynamic and ever-changing landscape, influenced by a myriad of factors ranging from economic indicators to geopolitical events. As of November 2024, the stock market is experiencing a mix of challenges and opportunities. Let’s delve into the current scenario and what investors can expect moving forward.

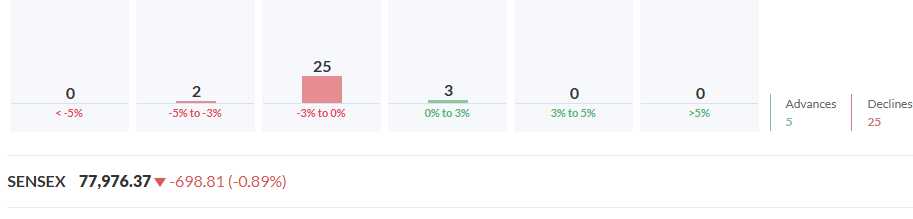

Market Performance Overview

The Indian stock market has seen a period of volatility in recent months. While sectors like Electricals have shown impressive growth, others such as Industrial Gases, Retailing, and Diamond & Jewelry have faced significant declines. This mixed performance reflects varied investor sentiment and economic factors.

Key Factors Influencing the Market

- Economic Growth: India’s GDP growth is projected to be around 6.1% over the next five years, positioning it as the world’s third-largest economy by 2027. This long-term growth potential continues to attract investors.

- Sectoral Performance: Certain sectors like Electronic Manufacturing, Power, and Infrastructure are expected to benefit from India’s push to become a key player in the global supply chain.

- Global Economic Conditions: Global economic uncertainties, including fluctuating oil prices and trade policies, have impacted investor confidence.

- Domestic Factors: Recent extreme weather events and slower-than-expected earnings growth have added to market volatility.

Investor Sentiment and Strategies

Despite recent challenges, investor sentiment remains cautiously optimistic. The market has seen strong participation from domestic institutional investors and a surge in retail participation. To navigate this scenario, investors are advised to focus on companies with strong fundamentals and a history of good results.

Conclusion

The current stock market scenario presents both challenges and opportunities. By staying informed and adopting a strategic approach, investors can navigate the market effectively. Keeping an eye on economic indicators, sectoral performance, and global trends will be crucial in making informed investment decisions.

Based on today’s market analysis, here are some recommendations:

Buy

- TVS Motor Company: Axis Securities maintains an ‘overweight’ rating with a target price of Rs 2,890, anticipating a 13% YoY growth in total volumes for FY25.

- GAIL (India): Motilal Oswal Financial Services has reiterated its ‘buy’ call with a target price of Rs 265.

- UltraTech Cement: Geojit Financial Services upgrades it to a ‘buy’ rating with a target price of Rs 12,320.

- LT Foods: Motilal Oswal Financial Services has issued a ‘buy’ call with a target price of Rs 520.

- Larsen & Toubro: LKP Securities recommends buying shares with a target price of Rs 4,070.

Hold

- Bombay Dyeing & Mfg Company Limited: Currently neutral with a recent return of +8%.

- CARE Ratings Limited: Bullish with a return of +47% over the last 30 days.

- DCM Shriram Limited: Neutral with a return of +14%.

Sell

- NLC India: SELL recommendation.

- Mahanagar Gas: SELL recommendation.

These recommendations are based on current market trends and analysis. It’s always a good idea to consult with a financial advisor before making any investment decisions.

![]()