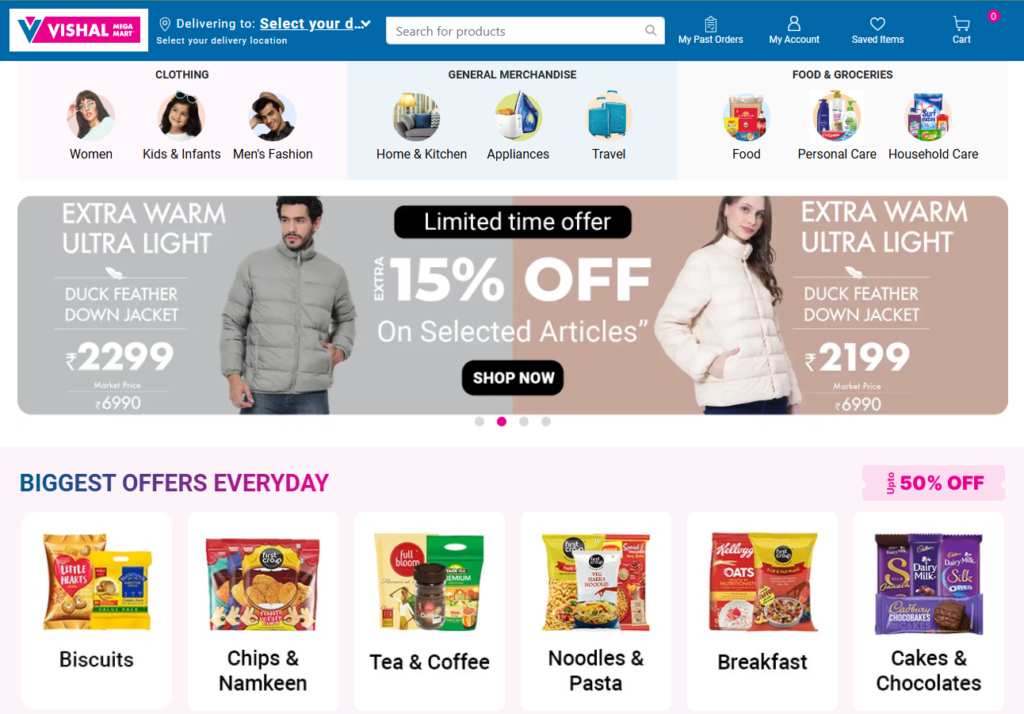

Vishal MegaMart IPO: A Comprehensive Overview

The Indian retail sector is abuzz with excitement as Vishal MegaMart, one of the largest organized retail chains in the country, gears up for its Initial Public Offering (IPO). The IPO, which opened on December 11, 2024, aims to raise a whopping Rs 8,000 crore through an offer-for-sale (OFS) mechanism. Here’s a detailed look at the key aspects of the Vishal MegaMart IPO.

Key Details of the IPO

- Price Band: The shares are offered at a price band of Rs 74 to Rs 78 per share.

- Lot Size: The minimum lot size is 190 shares, making it accessible to a wide range of investors.

- Subscription Period: The IPO is open for subscription from December 11 to December 13, 2024.

- Listing Date: The shares are expected to be listed on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) on December 18, 2024.

Subscription Status

The IPO saw a strong response on the first day, with the issue being subscribed 18% within the first hour. Retail investors showed the highest demand, subscribing to their reserved category by 25%, while non-institutional investors (NIIs) also participated actively3. Qualified Institutional Buyers (QIBs) showed minimal interest.

Financial Performance

Vishal MegaMart has shown impressive financial growth over the past few years. The company’s total income grew at a compound annual growth rate (CAGR) of 28% from FY22 to FY24, reaching Rs 8,945.13 crore3. The Profit After Tax (PAT) for FY24 was Rs 461.94 crore, with an improved EBITDA margin from 4.24% in FY23 to 5.18% in FY24.

Market Potential

Vishal MegaMart operates in the rapidly growing retail sector in India. The company has a strong presence in tier-2 and tier-3 cities, which are expected to drive significant growth in the organized retail space5. The company’s aggressive store expansion plans and strategies to improve same-store sales growth are expected to drive future growth.

Analysts’ Views

Analysts have given a positive outlook for the Vishal MegaMart IPO. The company is trading at a price-to-earnings (P/E) ratio of 69x based on FY25 earnings, which is considered fairly priced compared to its peers1. Brokerage firms like Geojit Financials have issued a “Subscribe” rating, citing the company’s strong market presence and growth potential.

Conclusion

The Vishal MegaMart IPO presents an exciting opportunity for investors looking to tap into the burgeoning retail sector in India. With a strong financial performance and a promising market outlook, Vishal MegaMart is poised to make a significant impact in the retail space. However, investors should carefully consider the company’s valuation and their own investment goals before participating in the IPO.

![]()